2024 Nj Sales Tax Rate

2024 Nj Sales Tax Rate. The base level state sales tax rate in the state of new jersey is 6.63%. View a detailed list of local sales tax rates in new jersey with supporting sales tax calculator.

Components of the 6.63% freehold sales tax. Zip code 07728 is located in freehold, new jersey.

New Jersey Sales And Use Tax Rate In 2024 Is 6.625%.

The new jersey sales tax rate in 2023 is 6.625%.

New Jersey’s General Sales Tax.

Sales tax holiday for certain retail sales.

This Rate Applies Across The State, With No Additional.

Images References :

Source: americanlegaljournal.com

Source: americanlegaljournal.com

State And Local Sales Tax Rates, Midyear 2022 American Legal Journal, View a detailed list of local sales tax rates in new jersey with supporting sales tax calculator. Local governments (like cities and counties) are not allowed to charge local sales taxes on top.

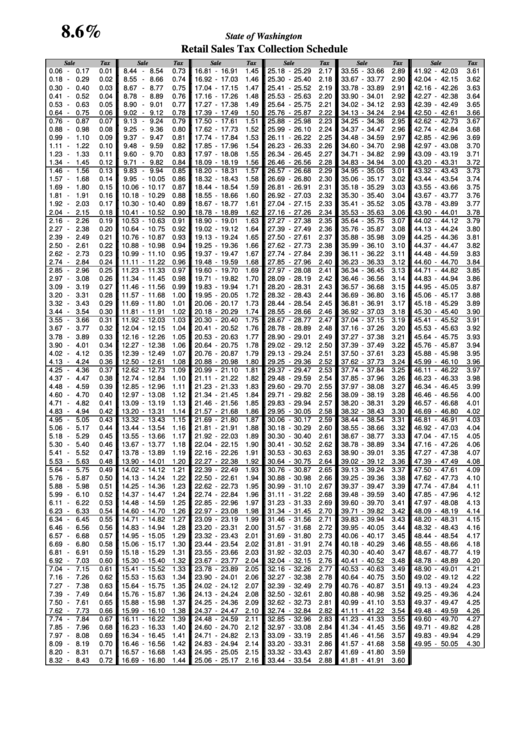

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Printable Sales Tax Chart, Additional sales tax is then added on depending on location by local government. Get downloadable new jersey sales tax rate spreadsheets for your business.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, What is the tax rate range for new jersey? Local governments (like cities and counties) are not allowed to charge local sales taxes on top.

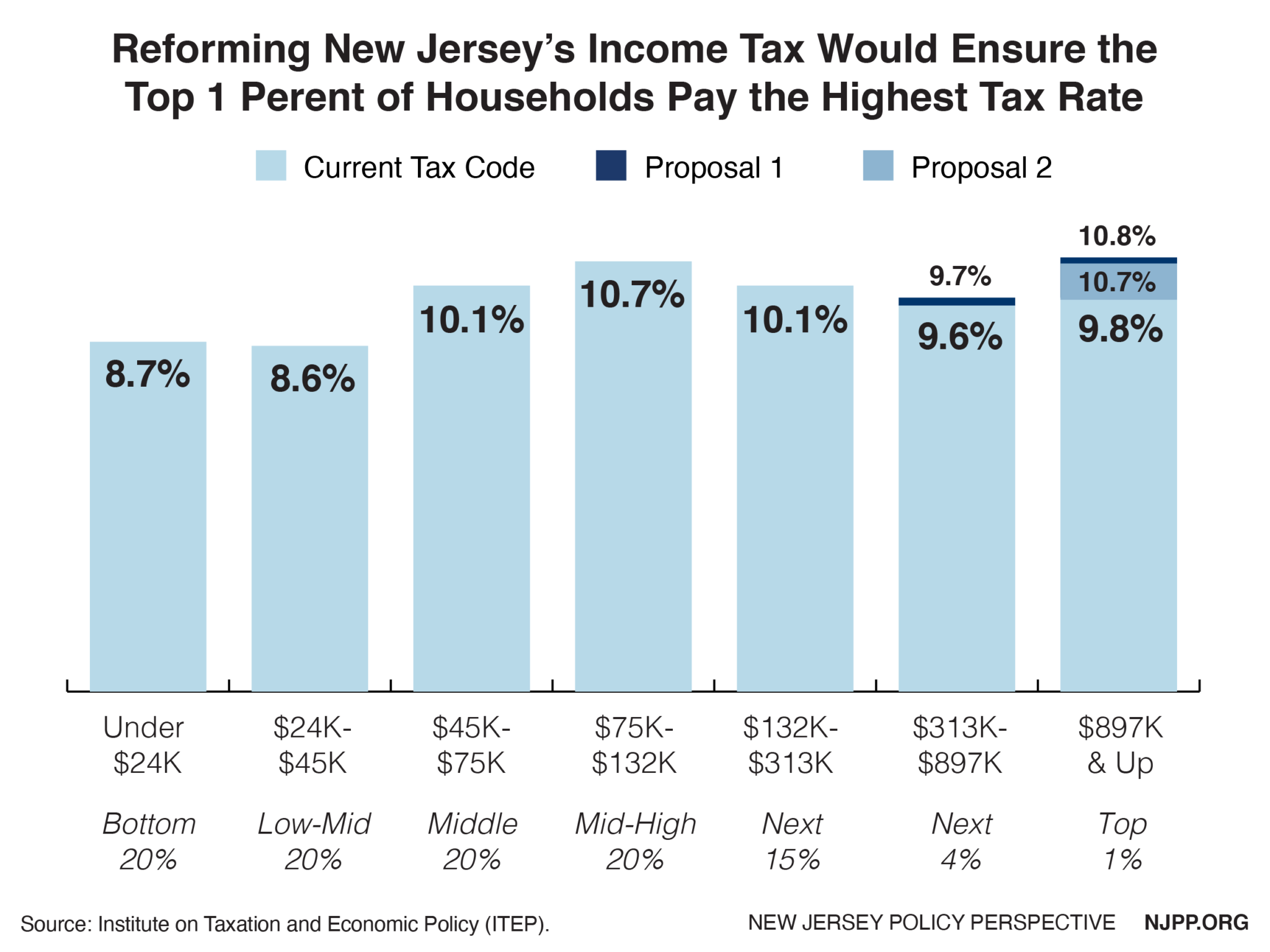

Source: www.njpp.org

Source: www.njpp.org

Road to Recovery Reforming New Jersey’s Tax Code New Jersey, New jersey’s general sales tax. Exemptions to the new jersey sales tax will vary by state.

Source: taxfoundation.org

Source: taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, Lowest sales tax (6.625%) highest sales tax (8.625%). Sign purchases and installation services sales and use tax effective october 1, 2022.

Source: talliawshara.pages.dev

Source: talliawshara.pages.dev

Tax Brackets For Taxes Due 2024 Nj Sonya Virgie, The new jersey sales tax rate is 7% as of 2024, and no local sales tax is collected in addition to the nj state tax. This rate applies across the state, with no additional.

-1920w.jpg) Source: www.salesandusetax.com

Source: www.salesandusetax.com

New Jersey Sales Tax Rate Decrease Agile Consulting, View a detailed list of local sales tax rates in new jersey with supporting sales tax calculator. New jersey sales tax rates & calculations in 2023.

Source: templates.esad.edu.br

Source: templates.esad.edu.br

Printable Sales Tax Chart, What is the sales tax rate in new jersey? This is the total of state, county and city sales.

![U.S. Sales Tax by State [1484x1419] MapPorn](https://external-preview.redd.it/t9sLze7hV6ZUinIl1h1wA8Vg4oASGxodMFiNWhYfjYE.png?auto=webp&s=08cfd4239c6068d48a2557b63d1d8404215a5da7) Source: www.reddit.com

Source: www.reddit.com

U.S. Sales Tax by State [1484×1419] MapPorn, What is the sales tax rate in jersey city, new jersey? The minimum combined 2024 sales tax rate for bergen county, new jersey is.

Source: 1stopvat.com

Source: 1stopvat.com

New Jersey Sales Tax Sales Tax New Jersey NJ Sales Tax Rate, Exemptions to the new jersey sales tax will vary by state. New jersey sales and use tax rate in 2024 is 6.625%.

New Jersey Has A Statewide Sales Tax Of 6.63%.

New jersey sales tax rates & calculations in 2023.

Look Up Sales Tax Rates In New Jersey By Zip Code With The Tool Below.

Components of the 6.63% freehold sales tax.